Reimagining Customer Life Cycle To Retain More Customers

Reimagining Customer Life Cycle To Retain More Customers

If you are in charge of customer retention in a recurring-revenue business, you know that your competition is always trying to poach your customers — and that your customers will jump ship after a bad experience, or in pursuit of a better deal. So what can you do to reduce churn? In my experience, most subscription businesses focus on process improvement and deploying a model to score end-of-term churn risk. However, the churn risk doesn’t happen overnight, and every bad experience is leading to an incremental risk of cancellation in the future. What I believe works in such situations is looking at the whole retention process, analyzing unstructured data and deploying multiple models to optimize retention efforts. Here’s an approach that has helped me identify customers who are at risk of cancellation very early in the life cycle.

Considering The Traditional Customer Life Cycle

The traditional customer life cycle offers insight into the customer’s potential needs in four stages:

1. Onboarding: Customers enter this stage immediately after contract.

2. Service: In this stage, companies try to deliver on their commitment to the customer.

3. Retention: A customer enters this stage when they are nearing the renewal date.

4. Win-back: Customers in this stage have not renewed the contract.

How Enterprises Handle Churn Across The Life Cycle Today

How Enterprises Handle Churn Across The Life Cycle Today

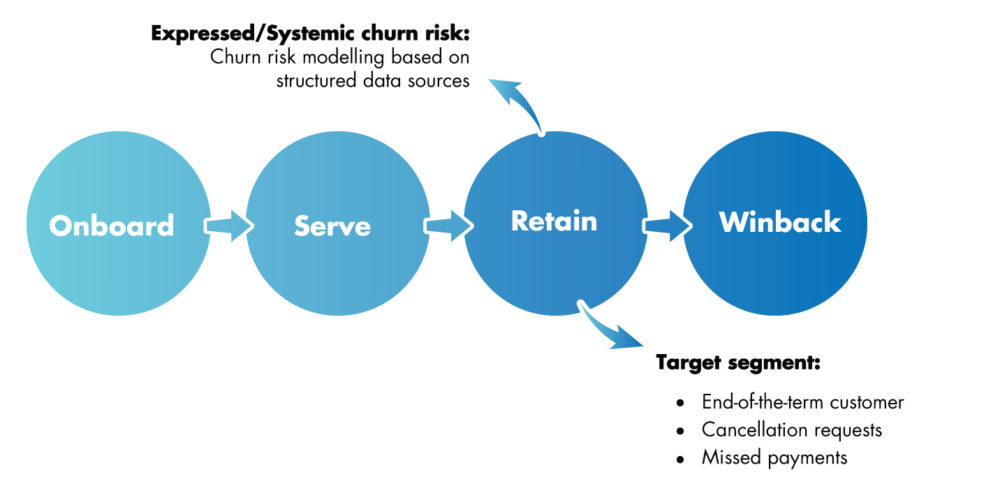

In working with leaders from industries such as telecommunications, where retention is a critical business metric, I have observed that the traditional life cycle framework above puts a lot of constraints on retention efforts. In addition, businesses often rely on structured data sources (such as acquisition type, transactions, pricing issues, product issues and tenure), which means the system doesn’t understand that a customer is at risk until they have already decided to cancel. There are a few disadvantages to this strategy:

1. Expensive retention: Winning back a customer who has made up their mind to cancel is usually expensive or futile.

2. Nonactionable churn: A big part of the structured churn (the churn indicated by structured data, such as pricing concerns) is difficult to act on because of the nature of these churn drivers.

3. Ineffective retention channels: The medium of choice for these retention campaigns is email, which is a known low-conversion channel.

4. One-size-fits-all offers: The offers are not tailored or meaningful to most customers, mainly because the marketers lack the insights to design tailored offers. This leads to low conversion rates and a waste of marketing dollars.

5. No regard for what is causing churn: Typical churn prevention efforts focus on symptoms, but tend to neglect what caused those symptoms in first place.

6. Neglect of customer lifetime value (CLV) growth: The typical intelligence that drives marketing efforts supports the prevention of revenue loss due to churn. However, since structured data can’t paint a full picture, any opportunities to grow revenue are blindsided.

Proactively Safeguarding Customer Value

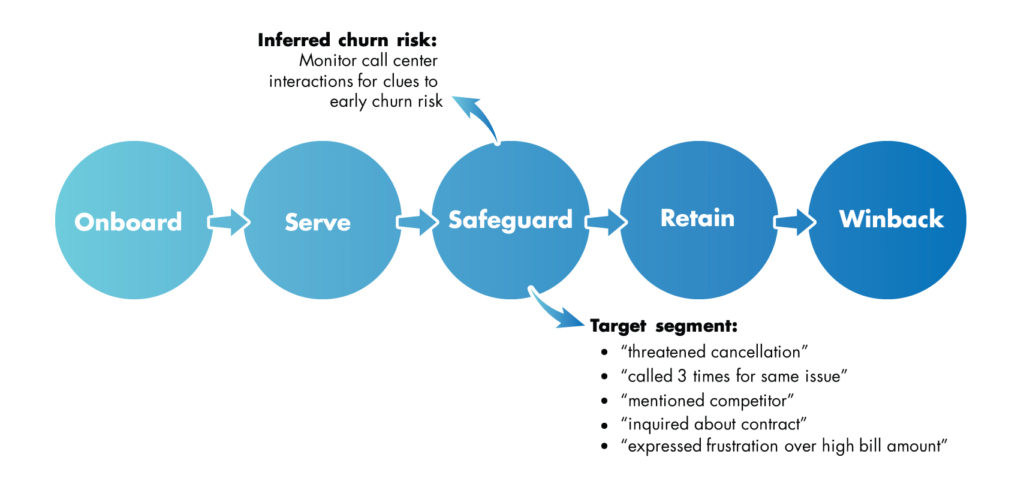

Instead of trying to retain those who are either already on the brink of cancellation or have already canceled, marketers can benefit from introducing a new stage to the life cycle: safeguard. I have used this approach and found that it opens up a whole new possibility of safeguarding valuable customers instead of letting the risk build up in the background. For me, it has delivered very high conversion rates compared to typical retention marketing offers.

In the safeguard stage, the focus is on identifying at-risk customers and engaging them proactively before the risk grows into a costlier retention problem.

1. Risk-based segmentation: Customer interactions in call centers provide clues to early signs of churn risk. I have helped clients leverage machine learning models that can segments customers into high-, medium- and low-risk segments based on the inferred as well as expressed risk. This helps the marketers in tailoring campaigns to achieve specific goals based on the predicted risk for each segment — e.g., the low-risk segment can receive cross-sell or upsell offers, while the high-risk segment needs proactive offers and resolution to mitigate the higher churn risk.

2. Risk-aware care: Once the high-risk customers are identified, they can be identified (using interactive voice response) whenever they call customer care and routed automatically to a specialized group of agents who are empowered to offer proactive resolution and reverse the churn risk.

3. Risk-aware marketing: Based on the risk profile of high-risk customers, other customers who share a similar profile can be approached proactively via multiple channels (e.g., Facebook) and touch points (mobile app, website) with a tailored offer based on the root cause of their churn risk.

4. Risk-aware operations: The awareness of risk can be shared across operations such as field service in order to deliver differentiated treatment to customers who have started exhibiting higher churn risk.

How To Implement The Safeguard Approach

- Identify untapped sources of customer experience insights. These will help achieve the additional boost in retention rates.

- Bring all these sources into a single analytics hub, instead of siloed analytics.

- Create a life cycle view of customer risk instead of treating retention as an end-of-term problem only. This will help you create proactive strategies to prevent churn risk escalation instead of reactive strategies, which will always have huge time constraints before the customers actually cancel.

- Train your customer care representatives for proactive engagement and resolution while a customer is on the call — this change leads to higher conversion rates compared to any other channel.

With fleeting customer loyalties, intense competition and unprecedented technology-led changes in markets, enterprise subscription businesses can’t rely on technologies and tactics that worked yesterday. Reimagining how you view the customer life cycle and being proactive with customer issues and risk will help you boost profitability and prevail over your competition.

Originally published on Forbes

How Enterprises Handle Churn Across The Life Cycle Today

How Enterprises Handle Churn Across The Life Cycle Today