Insurance and Warranty

Insurance and Warranty

Overview

The global insurance industry has the potential to grow to $375 billion by 2022. The key driver for this growth will be customer-centric approaches. Industry leaders are focusing on improving overall customer experience (CX) and engagement with the hopes of creating customer loyalty, reducing churn in particular, and boosting plan ratings and reviews with the focus on accelerated growth and improved profitability.

To address this complex challenge, VOZIQ reimagines ways to improve customer experience and engagement and how churn can be predicted and prevented by focusing on uncovering early dissatisfaction and churn risk across the whole customer lifecycle. This enables operational leaders within the insurance to proactively provide differentiated treatment to at-risk customers even before they cancel.

Aptive Environmental prevented more than 50,000 cancellations with VOZIQ’s Predictive Customer Retention AI.

Insurance Use Cases

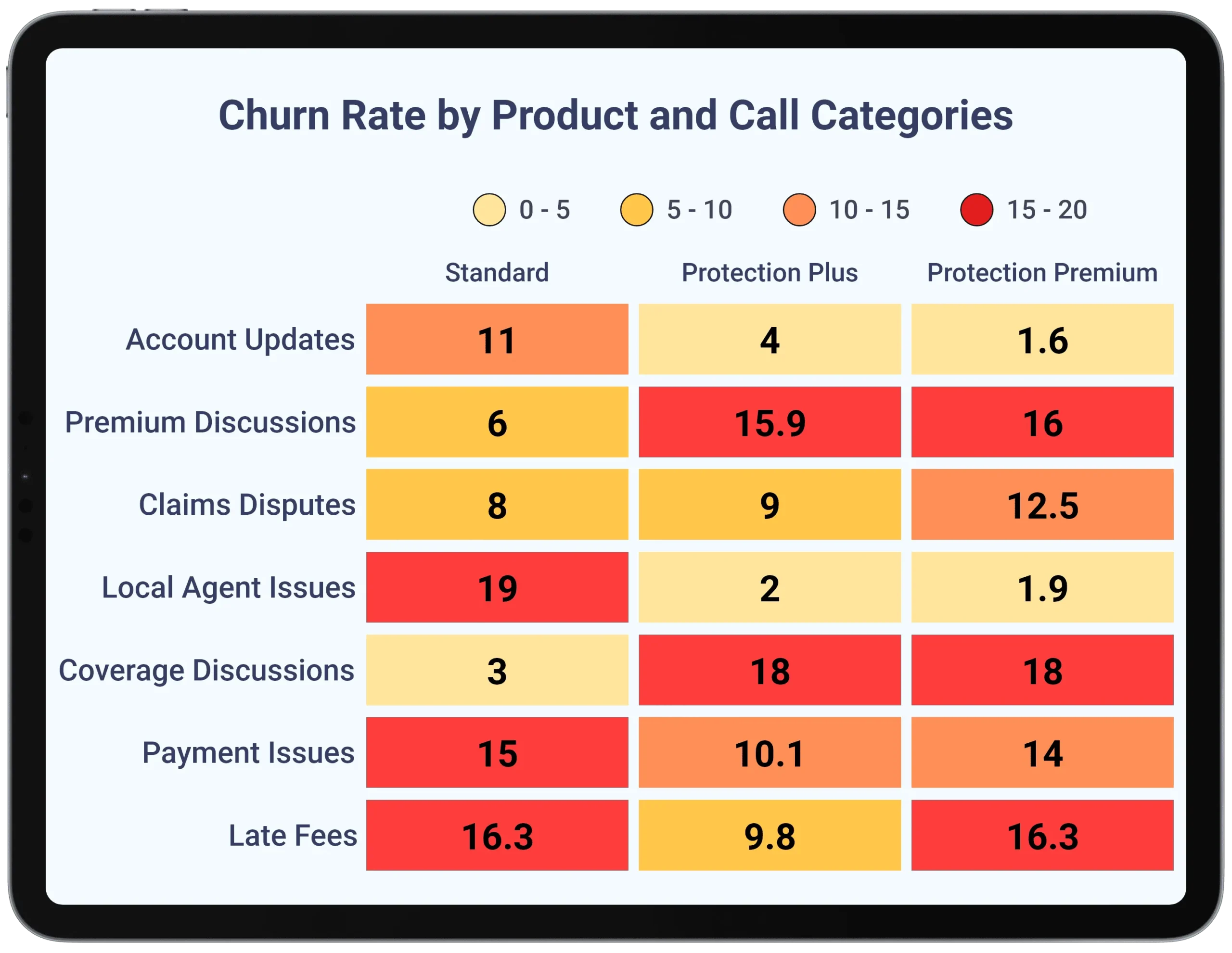

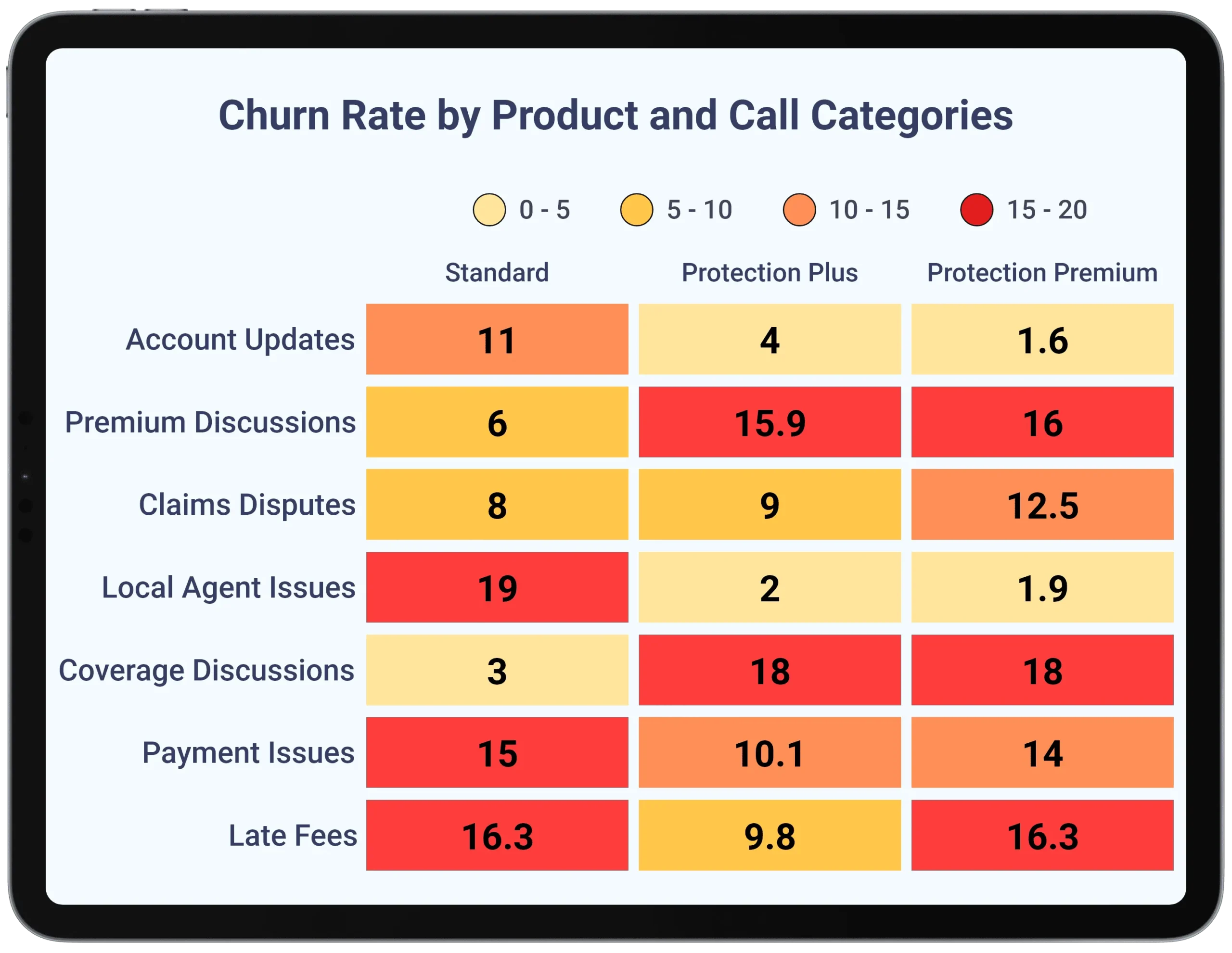

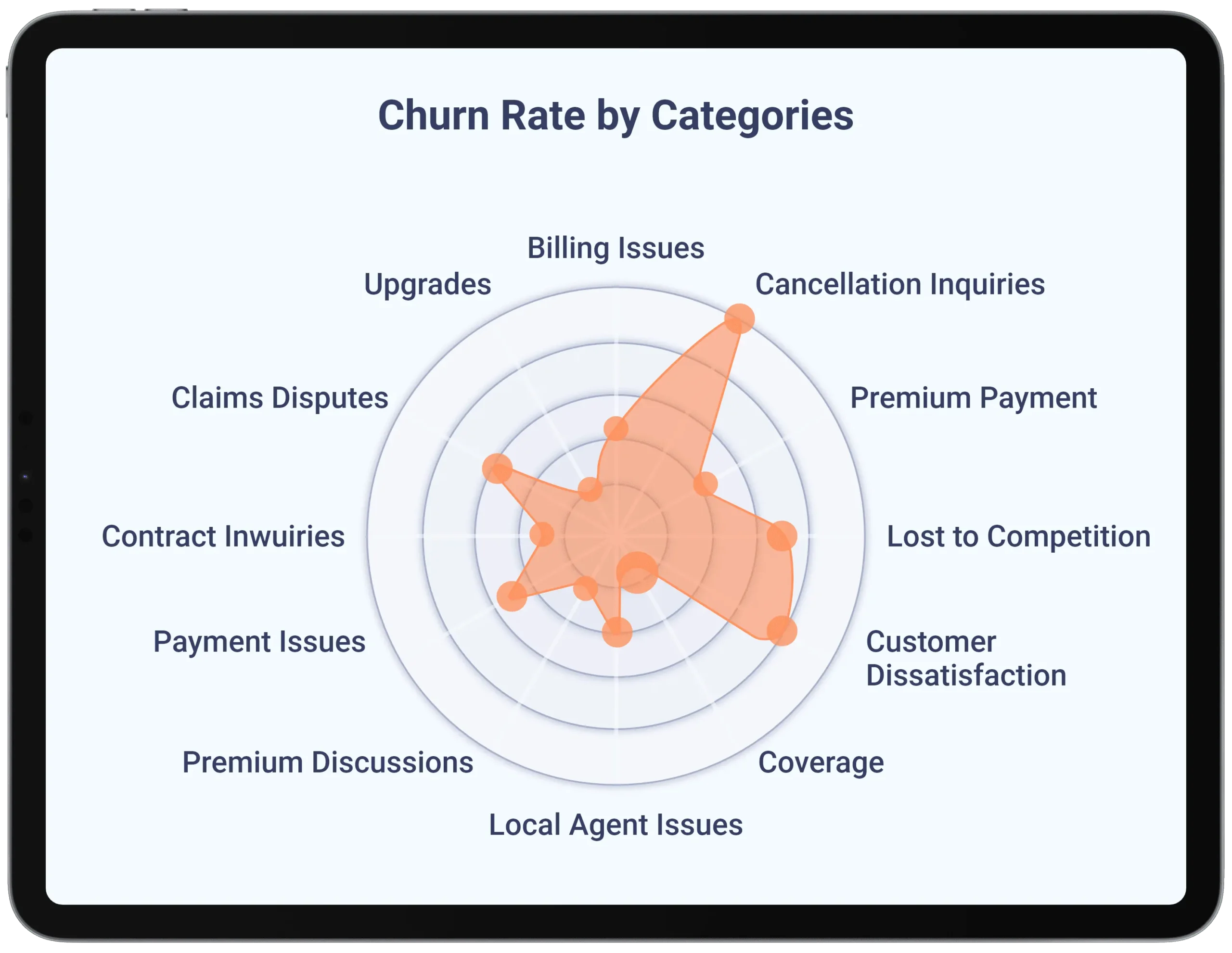

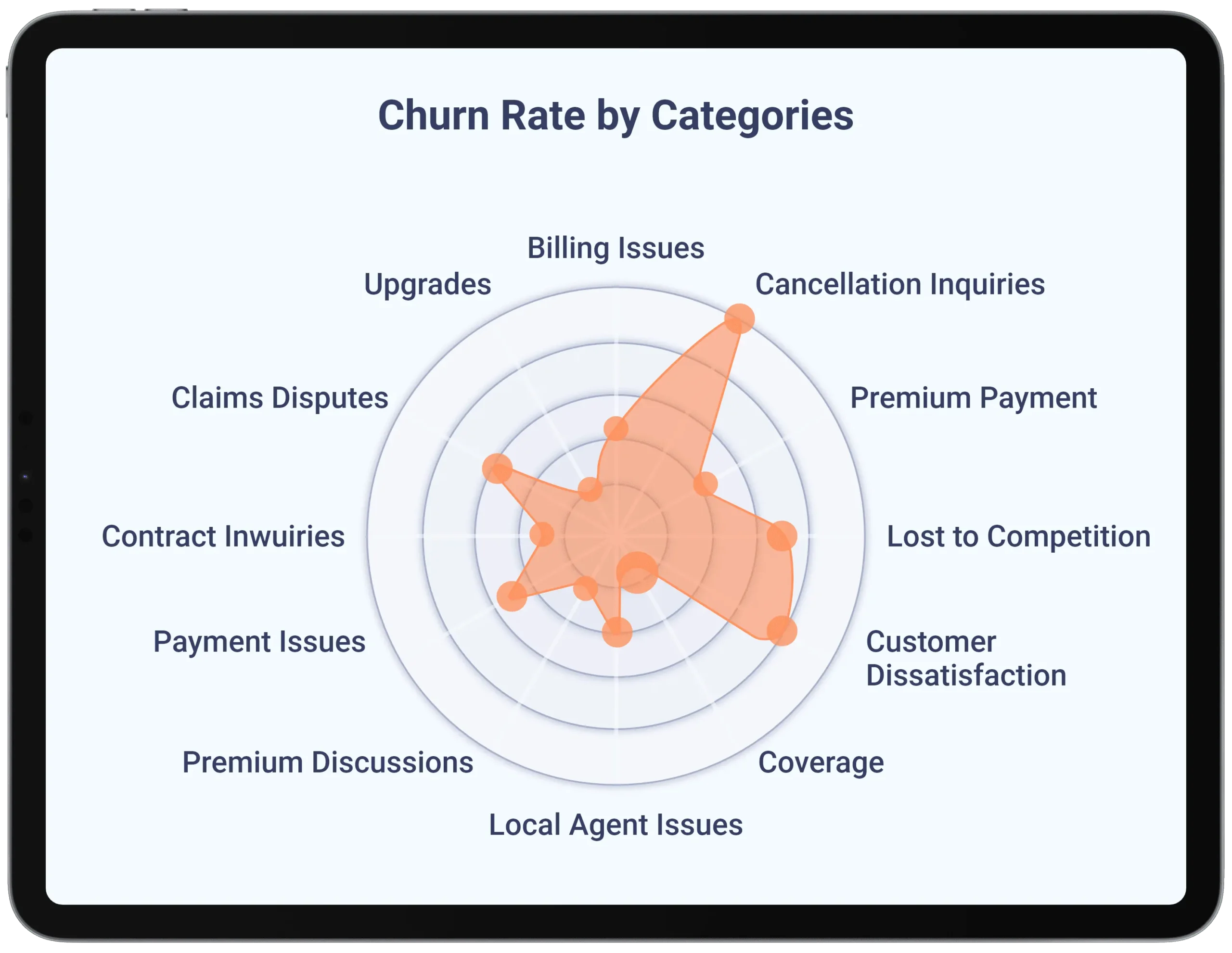

Track Risk by Products/Plans and Call Reasons

Reveal which products/plans/agents are driving churn risk.

Track Risk by Products/Plans and Call Reasons

Reveal which products/plans/agents are driving churn risk.

Track Risk by Geo-Locations

Map relative risk based on volume of dissatisfied and at-risk customers across locations.

Track Risk by Geo-Locations

Map relative risk based on volume of dissatisfied and at-risk customers across locations.

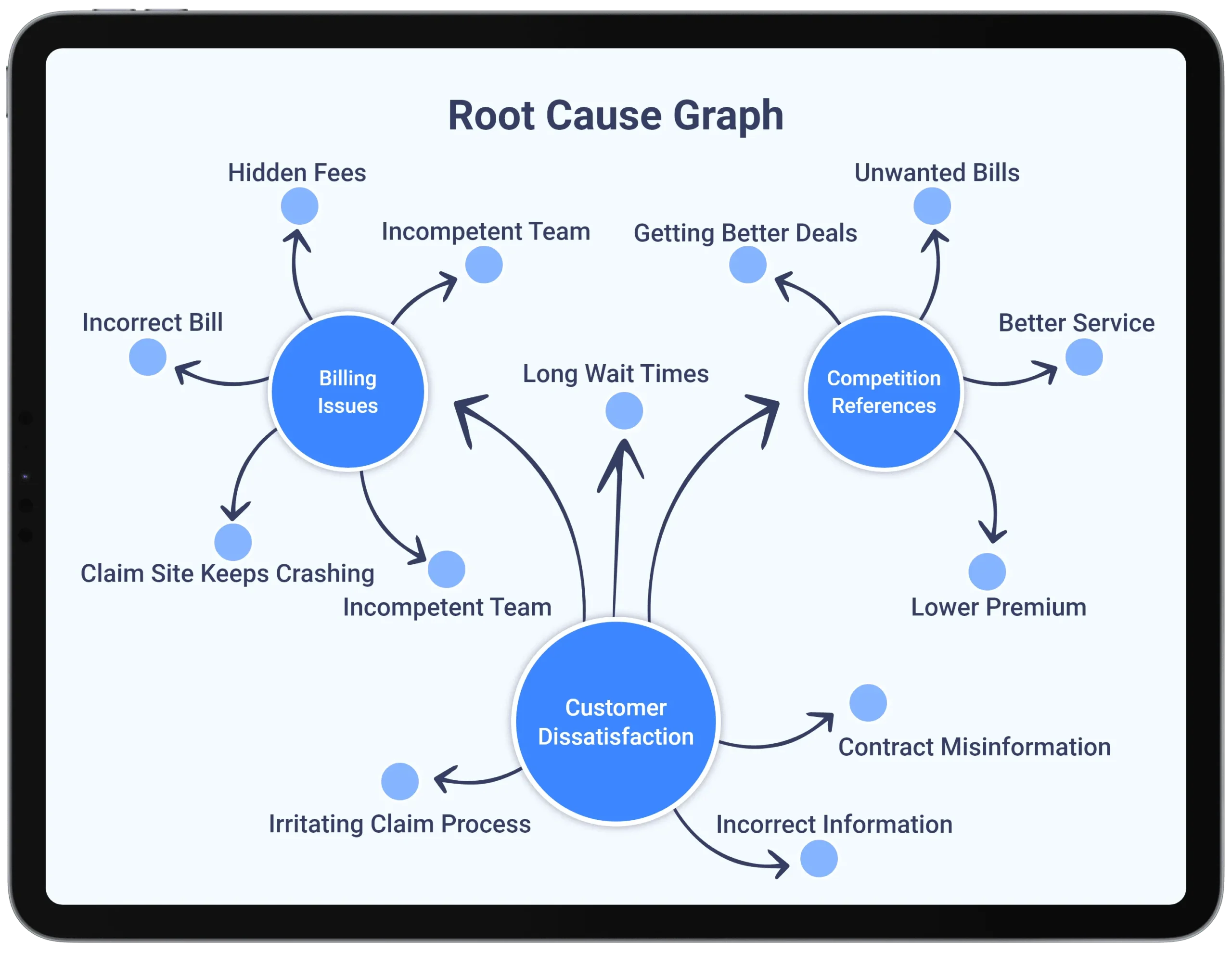

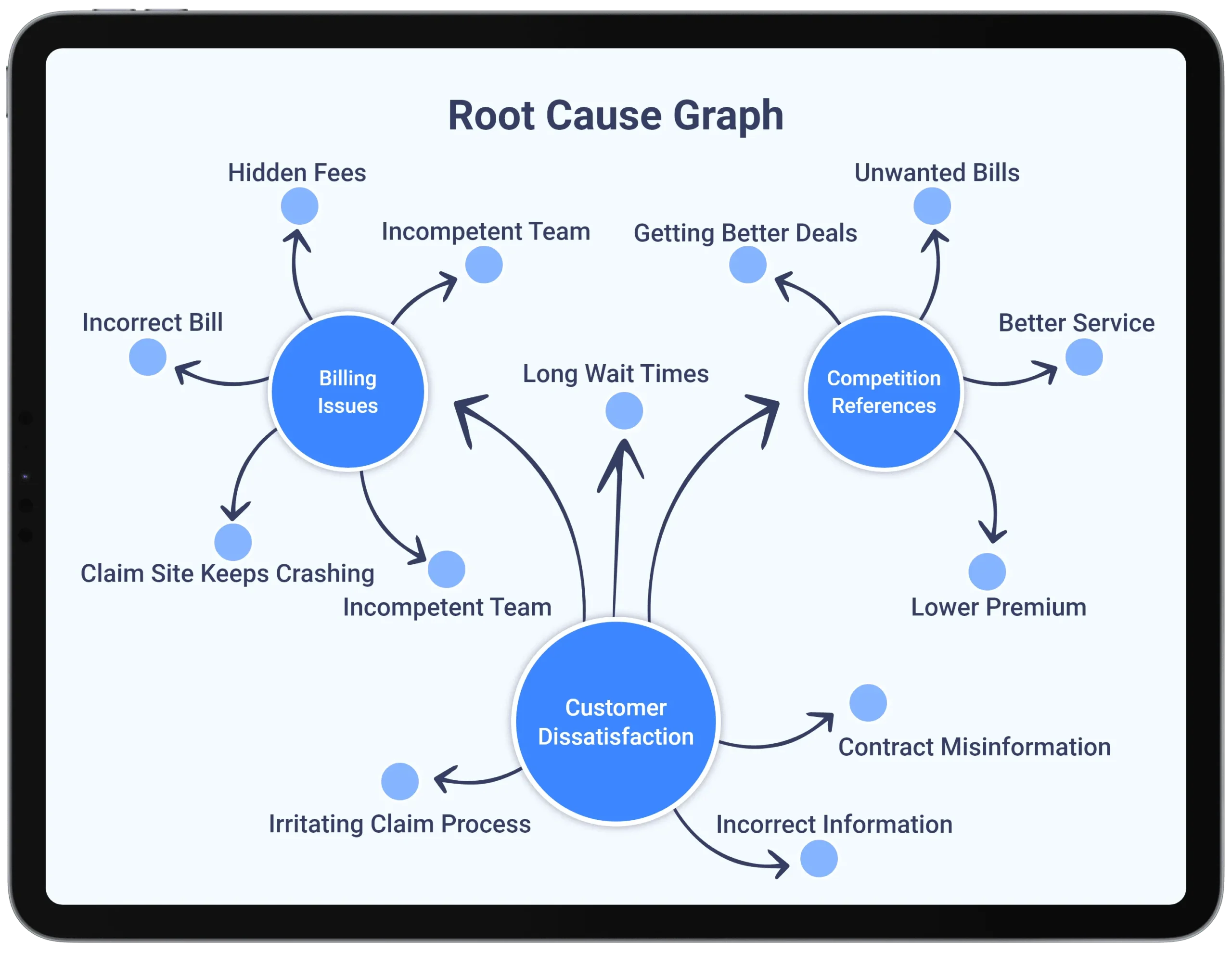

Understand Risk Drivers

Understand Risk Drivers

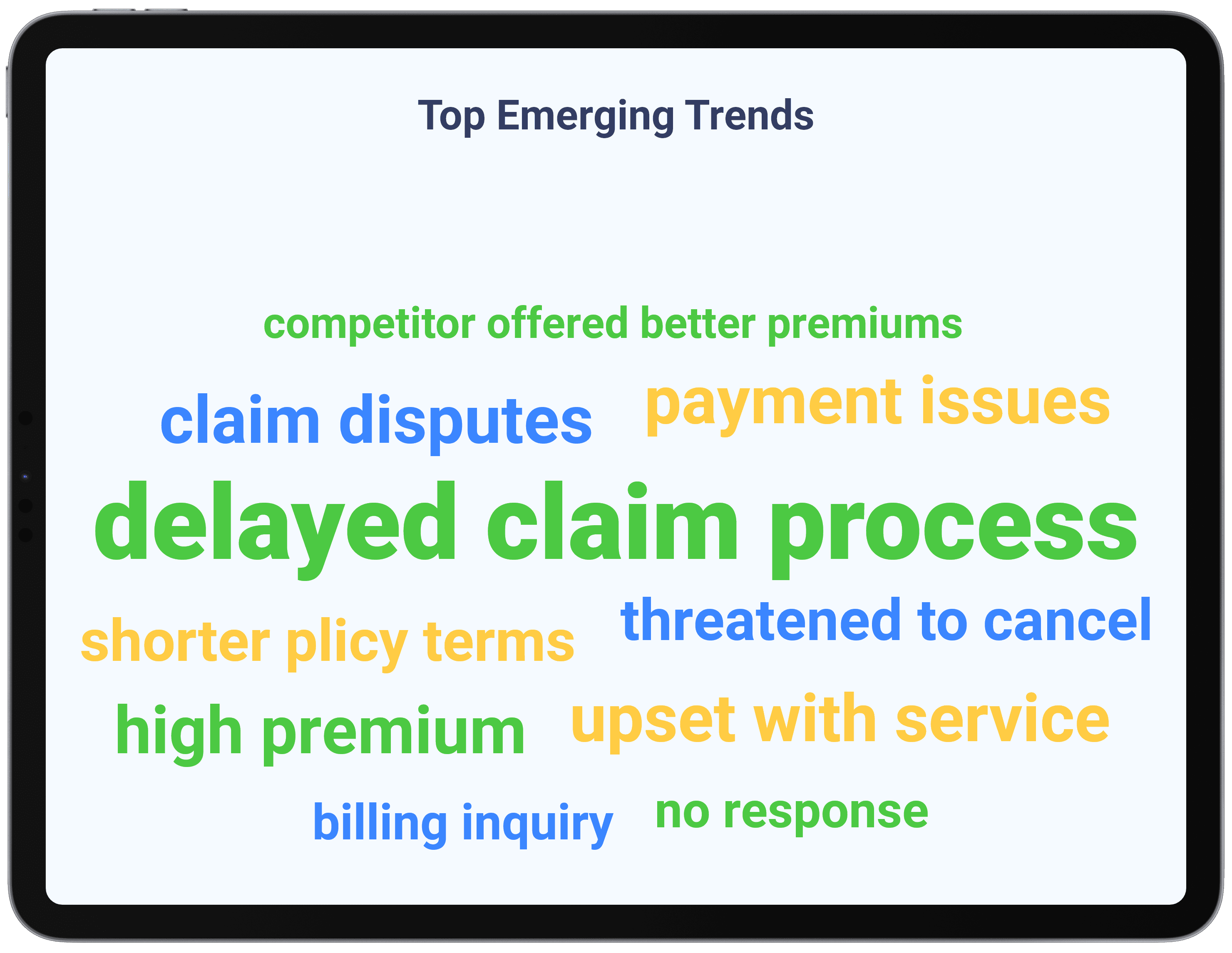

Identify Trending Topics

NLP for automatic topic identification from customer interactions.

Identify Trending Topics

NLP for automatic topic identification from customer interactions.

Discover Addressable Churn

Score quick wins by identifying customer segments that have addressable churn risk.

Discover Addressable Churn

Score quick wins by identifying customer segments that have addressable churn risk.

Optimize Care Costs

Track and improve service productivity by correlating agent performance with business metrics.

Optimize Care Costs

Track and improve service productivity by correlating agent performance with business metrics.

Create Frictionless Journey

Identify friction points and design self-service options.

Create Frictionless Journey

Identify friction points and design self-service options.

Build Competitive Intelligence

Gather information about your competitors’ products, services and offerings to stay ahead of the curve and win market share.

Build Competitive Intelligence

Gather information about your competitors’ products, services and offerings to stay ahead of the curve and win market share.

Reduce Customer effort

Identify drivers of effort with granular call categorization and repeat call mapping.

Reduce Customer effort

Identify drivers of effort with granular call categorization and repeat call mapping.

AI techniques that big tech companies like Google and Amazon are using, and those have made the

real difference for us"

Handpicked Insights

Handling Churn across the Customer Lifecycle

Customers do not decide to cancel overnight. Hence, retention approaches focused on the end of term are inadequate. Instead, they need to consider the entire lifecycle.

PLAYBOOK

Visualize Unstructured Data

Drive successful retention programs using contact center unstructured data.

CASE STUDY

Customer Success Stories

Explore the stories of retention transformation driven by VOZIQ.