It Is Time To Reinvent Your Customer Retention Strategy

It Is Time To Reinvent Your Customer Retention Strategy

Today, one poor customer service experience can trigger a customer to switch to your competition. According to a Forrester report, customers are increasingly driving up revenue risk, as they don’t mind doing business with competitors if their expectations are not met. The report also estimates that firms will experience a 25%-50% increase in revenue risk due to bad customer experiences, so efforts to retain customers must be given the utmost importance.

What Causes Customer Revenue Risk?

Based on our work with leading recurring revenue businesses, listed below are the three key reasons why subscription businesses face higher revenue risks today:

1. Customer Interaction Feedback Is Neglected, Resulting In Unmet Customer Expectations

Companies rely on post-call surveys to understand their customers. Historically, the response rate for customer surveys has been between 10%-15% for most companies. With such a low response rate, it is impossible to draw accurate conclusions with respect to the whole customer base. This results in faulty strategies and unmet customer expectations. On the other hand, in your call centers, customer service representatives, who interact with customers directly, add notes to every customer interaction as part of their post-call activity. These notes can be used to infer customer feedback or human-interpreted intelligence created by your trained agents. We have seen that most businesses fail to use this treasure trove of data, as unstructured interactions have never really been a major ingredient of traditional retention solutions.

2. Inability To Uncover Root Causes Of Dissatisfaction And Cancellations

With surveys, companies face issues such as biased response samples, low coverage and variation in customer interpretation of the scales typically used in these surveys. Businesses deploying speech analytics for better coverage end up constrained by the accuracy of speech mining and complexity of true insight generation. As a result, most businesses end up uncovering overall trends of customer experience metrics but have no scalable way to dig deeper and understand the “why” behind the numbers that their analytical tools throw up.

3. Unable To Detect Churn Risk Early In the Customer Lifecycle

Most companies focus on the end-of-life cycle churn or the last incident before cancellation reasons. However, it is often a series of incidents that leave a customer frustrated for a long period, ultimately driving the cancellation. With a limited feedback mechanism, companies miss out on addressing customer issues on time consistently, thus leaving them with very little or no time for addressing the root causes of churn risk.

What Can Customer-Obsessed Businesses Do To Take Control Of The Situation?

First, get a complete view of risk in the context of the customer journey.

Then, understand and visualize the end-to-end customer experience. This will help all key stakeholders on your teams to deepen their understanding of customer behavior, actions and feelings across touch points in their journey and will make the situation more customer-focused.

Any customer-related program must have a long-term strategic focus on identifying and closing the customer experience gaps that are fuelling cancellations, on ways of operationalizing these insights and ultimately on creating a positive impact on the business. Such programs empower customer retention leaders to make value-driven decisions based on the three root causes of poor customer experience listed above.

You should also be prepared for the next customer action. Market research can reveal customer desires, but the true focus must be on understanding a customer’ motivation beforehand, detecting churn risk as early as possible, understanding its root causes and delivering meaningful engagement to your customers at every opportunity. Data-driven techniques and predictive analytics must be used and considered as an ongoing, iterative process that is not just about quick fixes.

How Leaders Succeed At The Retention Challenge

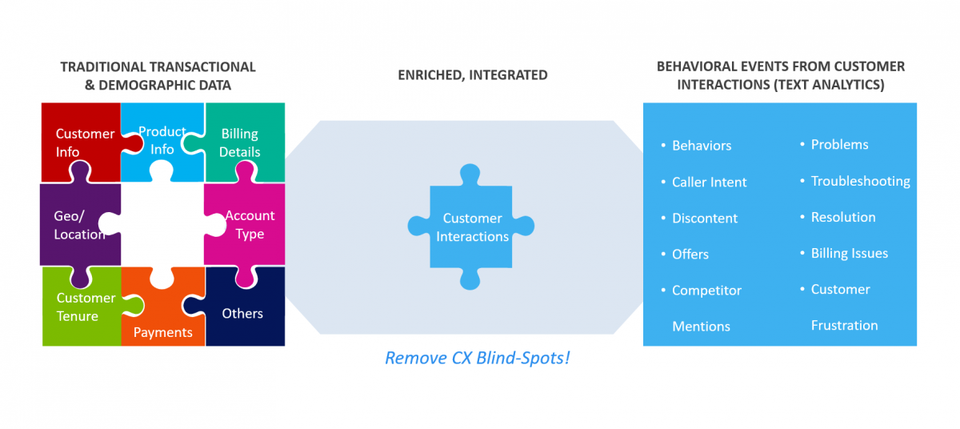

1. Make The Best Use Of Available Customer Data, Especially Interactions Data

It is time for companies to start developing an integrated customer data pool, incorporating new data sources. This includes unstructured data from their biggest customer listening post – their contact centers – along with other data such as device-generated data, to build more complex but accurate churn prediction models.

To deal with revenue risk, companies must deliver an effective customer experience every time a customer contacts them or when they contact the customer proactively. Enterprises must leverage these interactions to develop deep customer behavioral intelligence and further use them to understand drivers of customer dissatisfaction and cancellation at scale, with maximum coverage of their entire customer base.

2. Leveraging Advanced Technologies Such As Text Analytics And Machine Learning Technologies

Agent notes are a huge pool of unstructured text data. Here, advanced text analytics can help you quickly convert the unstructured text into meaningful insights which can support analysis, actions and strategic decision making.

In addition to giving you the opportunity to listen to your customers at scale, the benefits of text analytics and machine learning technologies include:

• Census-based diagnosis: Census-based diagnosis gives you the opportunity to develop behavioral intelligence to understand customer intent based on past historical data, understand customer sentiment with text analytics, gain competitive intelligence with competition identity models and quickly identify emerging trends using natural language processing (NLP) technology.

• Accurate predictions: Text analytics and machine learning allow you to develop and optimize churn-indicating parameters using machine learning models, predict churn risk very early in the customer life cycle stage and distinguish customers based on their propensity to churn.

If you are wanting to look more into machine learning models then here is an extensive list of web scraping proxy providers. Web scraping can help you enrich your models by providing more data for it to learn from.

Key Takeaways For Customer-Focused Businesses

Many customer-focused businesses are facing revenue risk because they rely on traditional retention approaches, with little focus on detecting emerging churn risk or identifying the root causes.

To address this challenge, businesses need to reinvent their retention strategies, start utilizing unstructured data sources and leverage advanced technologies such as text analytics and machine learning.

Originally published on Forbes